The Deep-Tech Funding Wave: How Exponent, Calligo, and Qosmic Are Leading India’s Frontier Innovation Charge

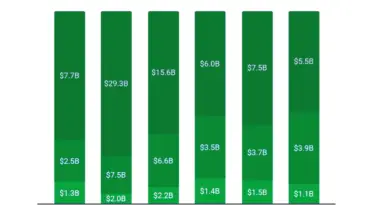

A powerful signal is flashing across India’s innovation landscape: deep-tech is no longer a niche—it’s the new mainstream. With funding in the sector surging 53% to $690 million in H1 FY26, a new wave of startups building in EV infrastructure, semiconductors, quantum communications, and space-tech is actively lining up significant capital rounds. This isn’t the tentative, exploratory funding of a few years ago; it is growth-stage conviction from top-tier investors like 360 One, BIG Capital, Accel, and Avaana Capital, backing ventures with proven business models, defensible IP, and clear paths to scaling.

The quartet of startups currently in the spotlight—Exponent Energy, Calligo Technologies, Qosmic, and Sanyark Space—represents the vanguard of India’s ambition to own the foundational layers of the 21st-century economy. Their collective pursuit of capital, ranging from seed rounds to significant growth infusions, paints a picture of an ecosystem that is maturing, diversifying, and ready to compete on the world stage.

Deal Spotlight: The Four Pillars of Frontier Innovation

1. Exponent Energy: Charging the EV Revolution

The Bengaluru-based startup, known for its groundbreaking rapid charging technology that can charge an electric vehicle from 0-100% in under 15 minutes, is in advanced talks to raise $22–28 million (₹190–250 crore) in a round led by 360 One. With participation from existing stalwarts like Eight Roads Ventures and TDK Ventures, this round would value the company at approximately $150–180 million—a significant leap from its ~$90 million valuation in 2024.

- The Fuel Use: Scaling its proprietary charging network, expanding into new business lines, and accelerating deployment of its solutions for commercial EV fleets.

- Why It Matters: Exponent is solving the single biggest psychological barrier to EV adoption—range anxiety and long charging times. Its success is critical to electrifying India’s logistics and public transport sectors.

2. Calligo Technologies: Building India’s Silicon Brain

This semiconductor startup is putting together a $10 million (₹90 crore) round led by BIG Capital. Calligo is focused on developing a next-gen silicon platform for high-performance computing (HPC) and AI hardware.

- The Fuel Use: Advancing its chip design, hiring specialized VLSI and systems talent, and positioning its IP for integration into AI accelerators and edge computing devices.

- Why It Matters: As the world scrambles for compute, India’s ability to design its own chips for AI workloads is a matter of strategic sovereignty. Calligo represents a bet on homegrown silicon intelligence.

3. Qosmic: Securing the Quantum Future

Qosmic is seeking $1.5–3 million from investors including South Park Commons (SPC) and Accel. The startup operates at the cutting edge of quantum communications infrastructure, building systems for ultra-secure data transmission based on quantum principles.

- The Fuel Use: Developing its core technology, building prototypes, and establishing proof-of-concept deployments for sectors requiring unhackable communication (defense, finance, government).

- Why It Matters: Quantum communications is the ultimate frontier of cybersecurity. India’s early entry into this field, led by startups like Qosmic, is essential for future-proofing its digital infrastructure against the eventual advent of quantum computing-powered decryption.

4. Sanyark Space: Redefining Satellites with Software

This satellite-tech venture is in advanced stages to secure $2 million from Avaana Capital, a climate-focused fund, valuing the company at $8–10 million (following a recent $500K pre-seed from AUM Ventures’ India DeepSpark program). Sanyark is developing software-defined, multi-mission LEO satellites for precision navigation and communication.

- The Fuel Use: Completing its satellite design, building engineering prototypes, and preparing for launch and in-orbit demonstrations.

- Why It Matters: Software-defined satellites represent the future of space agility—allowing missions to be reconfigured in orbit. Sanyark is positioning India in this critical, high-value segment of the new space economy.

The Macro Trends: Why Deep-Tech is Suddenly “Hot”

This flurry of activity is not random; it is the result of powerful, converging forces:

- Policy as a Catalyst: The government’s recent expansion of the ‘Deep Tech Startup’ definition (20-year recognition, ₹300 crore turnover cap) and the approval of the ₹10,000 crore Fund of Funds 2.0 provide a stable, long-term policy and capital foundation.

- Investor Maturation: Indian and global investors have developed the specialist knowledge and patience required to evaluate and back capital-intensive, long-gestation ventures. They are no longer just looking for quick SaaS exits.

- Talent & Traction: India’s deep-tech talent pool has grown, and startups now have demonstrable traction—patents filed, pilots completed, and early revenue—that de-risks the investment case.

- Geopolitical Tailwinds: The global push for supply chain diversification and technological sovereignty has made investing in Indian deep-tech a strategic imperative for global funds.

The Foundation for a Tech-Sovereign India

The funding pursuit by Exponent, Calligo, Qosmic, and Sanyark Space is more than a collection of deals; it is a blueprint for India’s technological future. It shows that Indian entrepreneurs are now building the fundamental infrastructure of the next industrial age—the energy systems, the computing platforms, the secure communications networks, and the space assets.

For investors, the message is clear: deep-tech in India has moved from the “visionary” column to the “viable” column. For the ecosystem, it signals that the long-held dream of India as a creator, not just a consumer, of foundational technology is finally becoming a reality. The frontier is no longer a distant horizon; it is being built, right here, right now.

Stay tuned to Startup Point for updates on these and other deep-tech funding rounds as they close, and for in-depth analysis of the sectors defining India’s next wave of innovation.