The Homegrown Advantage: How Indian Domestic Founders Are Outscaling the “Returnee” Myth

A paradigm-shifting study by AnnaLee Saxenian and Vivek Wadhwa, analyzing 596 Indian high-tech startups, has delivered a powerful counter-narrative to a long-held belief in India’s entrepreneurial ecosystem. The research reveals that founders with purely domestic backgrounds—no overseas education or work experience—are now statistically outperforming their “returnee” counterparts in the most critical metrics of long-term success: higher survival rates, greater employee growth, and superior valuation and revenue outcomes.

This “Indian Returnee Paradox“ marks a watershed moment in the maturity of India’s startup story. It signals the end of an era where a Stanford degree or Silicon Valley stint was considered an automatic marker of superior potential. Instead, it celebrates the rise of the homegrown founder—deeply embedded in the fabric of Indian market realities, consumer psychology, and operational constraints—as the primary engine of resilient, scaled value creation.

Deconstructing the Paradox: Why Homegrown Founders Are Winning the Long Game

The study illuminates a fundamental divergence in founder trajectories:

- The Returnee’s Early Advantage: Founders with overseas experience often excel in the 0-to-1 phase. They leverage global networks for seed funding, bring polished pitching skills, and can articulate a vision that resonates with international investors. Their initial traction can be swift.

- The Homegrown Founder’s Scaling Prowess: However, when it comes to the grueling 1-to-100 journey, domestic founders pull ahead. Their innate, often unspoken advantages include:

- Deep “Bharat” Market Intuition: An intuitive, granular understanding of local consumer behavior, pricing sensitivity, distribution complexities, and vernacular nuances that cannot be acquired in a foreign MBA program. This is invaluable in sectors like fintech, ed-tech, and agri-tech.

- Resourcefulness and Frugal Innovation: A lifetime of navigating scarcity breeds capital efficiency and “jugaad” ingenuity. Homegrown founders are masters at achieving more with less, building robust unit economics from the ground up—a discipline that becomes a superpower during scale and economic downturns.

- Navigating the Regulatory Labyrinth: An instinctive grasp of India’s complex, multi-layered regulatory environment and the patience to build relationships within it, avoiding costly missteps.

- Building for Realistic Scale: They design organizations and products for the chaotic, diverse, and vast Indian reality, not for a sanitized global ideal. This results in more resilient business models.

The Ecosystem’s Evolution: A Changing Playing Field

The study’s findings are not an accident but a reflection of a structurally matured ecosystem:

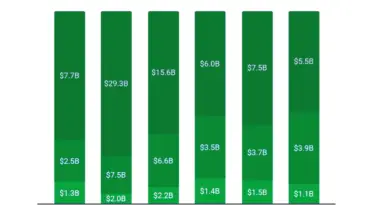

- Rise of Domestic Capital: With ₹11.2 lakh crore ($12.1B) in new domestic funds raised in 2025, access to early capital is no longer dependent solely on global networks that favor returnees.

- Policy Tailwinds for “Made in India”: Initiatives like the Deep Tech Startup policy and production-linked incentives (PLIs) reward building complex, India-specific solutions, a domain where local founders excel.

- A Massive Domestic “Living Lab”: India’s own market of 1.4 billion people provides a scale and diversity of problems that is unparalleled, giving homegrown founders a decisive R&D and product-market fit advantage.

The New Optimal Team: Hybrid, Not Hierarchical

The research clarifies that this isn’t a dismissal of returnee talent. Instead, it suggests an evolved, complementary model. The most successful ventures may be those founded by homegrown visionaries with deep market roots, who then strategically integrate returnee talent for specific roles:

- Global Expansion & Strategy

- Advanced R&D & Deep-Tech Specialization

- Institutional Investor Relations

- Brand Storytelling for International Audiences

In this model, the returnee acts as a force multiplier and bridge, not necessarily the originating visionary.

Implications for Investors and the Future

This study demands a recalibration of investor due diligence:

- Look Beyond the Pedigree: A flashy resume should be weighed against demonstrated market grit, local network depth, and capital efficiency.

- Value “Ground Truth” Experience: Prior experience scaling a business in Tier-2 India may be more predictive of success than experience at a FAANG company.

- Bet on Hybrid Leadership: Seek founding teams that combine local market dominance with global strategic acuity.

Conclusion: The Authenticity of Homegrown Innovation

The “Indian Returnee Paradox” study is a liberating document for the ecosystem. It validates that the most authentic, and often the most successful, Indian innovation springs from those who have lived its complexities.

It signifies that India’s startup ecosystem has come of age. It no longer needs to import its leadership template. The confidence, capability, and contextual intelligence required to build billion-dollar businesses are now homegrown, in abundance. This shift is the true mark of a sovereign innovation economy—one that trusts and rewards its native genius. The next generation of iconic Indian companies will not just be built in India, but will be built from the soil of India’s own unique challenges and opportunities, by founders who never had to leave to learn how to win.

Stay tuned to Startup Point for profiles of pioneering homegrown founders and analysis of the hybrid team models driving India’s next unicorns.