Resilience Redefined: How Selective Capital Forged a Stronger Indian Startup Ecosystem in 2025

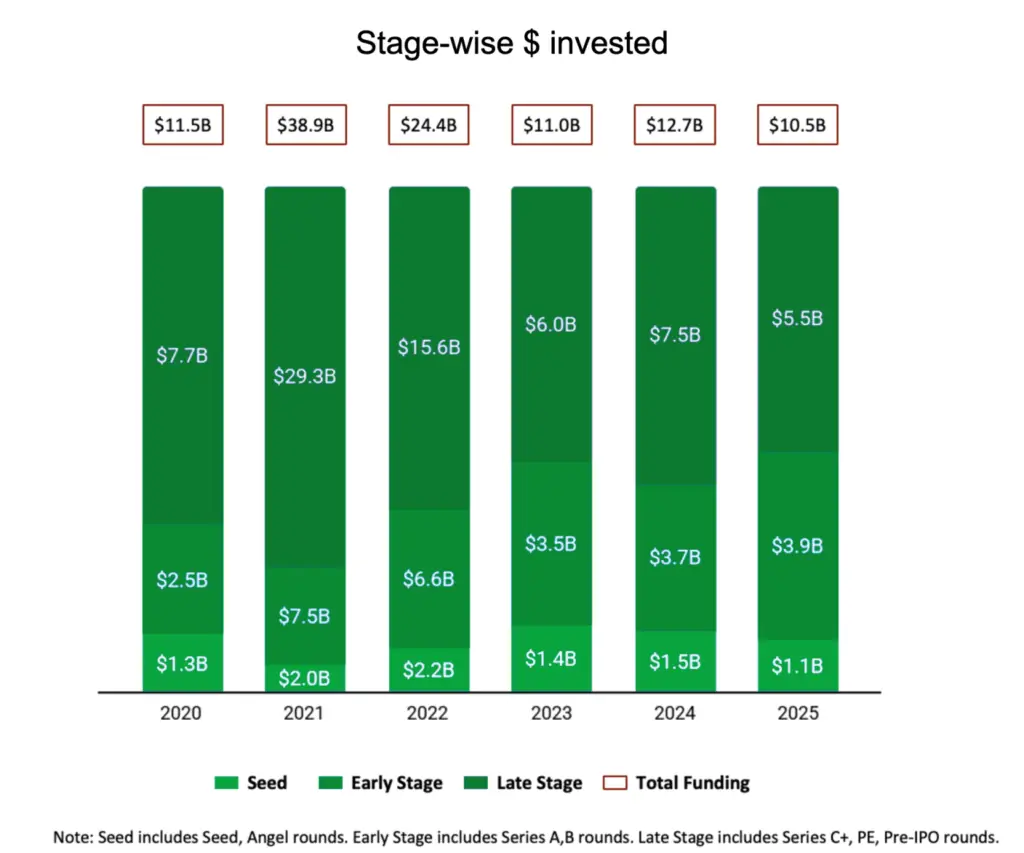

The year 2025 will be remembered not for a record-breaking funding spree, but for a strategic and disciplined consolidation that made India’s startup ecosystem fundamentally more resilient. With nearly $11 billion raised, the narrative shifted decisively from the “funding winter” of prior years to a “funding realignment,” where capital became a powerful tool for curation. Investors, armed with lessons from past excesses, prioritized scalable, profitable models with clear paths to monetization, favoring sustainable growth over unchecked blitzscaling. This selective approach, while leading to fewer overall deals, unlocked historic public market success and set the stage for a new era of quality-driven, global innovation from India.

The 2025 Funding Blueprint: Selectivity as a Superpower

The funding landscape of 2025 was characterized by a profound shift in investor behavior. The table below encapsulates the key trends that defined this pivotal year:

| Funding Characteristic | 2025 Manifestation | Strategic Implication |

|---|---|---|

| Overall Capital Inflow | ~$11 Billion raised, a disciplined consolidation from peak years. | Signals a move away from hype-driven funding to a focus on durable business fundamentals. |

| Sectoral Focus | Deep-tech & AI surged to $1.55B across 264 deals. Consumer-tech rationalized. | Capital is chasing high-margin, IP-driven businesses (AI, spacetech, biotech) over low-margin, high-burn models. |

| Deal Dynamics | Mega-rounds ($100M+) remained robust for proven winners, but overall deal volume dipped. | VCs are “doubling down” on portfolio champions with proven execution, rather than spreading bets thinly. |

| Investor Dry Powder | $12.1 Billion committed to 81 new India-focused funds (a 39% YoY increase). | Massive war chest signals long-term conviction, but this capital is reserved for the highest-quality ventures. |

This environment created a “survival of the fittest” dynamic that ultimately strengthened the ecosystem’s core. As experts noted, “2025 was the year of responsible capital – strong for the right founders.”

The Catalysts: What Fueled the Selective Boom

Several converging factors empowered this disciplined investment strategy and the ecosystem’s overall resilience:

- The Profitability Imperative: The market’s tolerance for cash-burning “growth stories” evaporated. Startups that streamlined operations, demonstrated positive unit economics, and outlined a credible path to profitability became magnets for capital. This shift was rewarded spectacularly by public markets, with a record 42 IPOs raising over $19 billion, validating the private market’s focus on sustainable business models.

- The Deep-Tech Breakout: The surge in deep-tech funding marked India’s graduation up the technology value chain. Investors backed startups building foundational technologies—semiconductors, AI models, space infrastructure, advanced robotics—that create defensible, long-term moats and address global supply chain needs. This move from consumer internet “features” to hard-tech “platforms” signifies a new level of ambition and capability.

- Infrastructure at Scale: The over $35 billion in commitments from Google, Microsoft, and Amazon for data centers, cloud regions, and AI infrastructure provided the critical public goods that Indian startups need to compete globally. This reduced a major bottleneck, allowing founders to build capital-efficient, software-led businesses on world-class infrastructure without massive upfront capex.

- The State as a Strategic Partner: Active state policies like Karnataka’s ₹518 crore fund, Maharashtra’s MATRIX incubator network, and Gujarat’s VC inflows decentralized growth. They provided early-stage grants, incubation, and market access, particularly for startups in Tier-2/3 cities and in sectors like agri-tech and sustainability, broadening the base of innovation.

The Ripple Effects: Building for Global Leadership

The selective funding of 2025 had profound positive ripple effects across the ecosystem:

- Liquidity Recycling and Talent Retention: The successful IPOs and acquisitions unlocked billions in returns for early investors and employees. This recycled capital is now flowing into new funds and angel investments, while wealth creation for early employees creates a new generation of founder-mentors and reduces talent drain.

- Enhanced Governance and Trust: The path to an IPO forced startups to adopt world-class corporate governance, financial reporting, and compliance standards. This builds greater trust with institutional investors, global partners, and regulators, elevating the entire ecosystem’s reputation.

- Inclusion as an Innovation Driver: The statistic that half of India’s 2 lakh+ recognized startups have a woman director is a powerful competitive advantage. This diversity of perspective is a proven driver of innovation and resilience, ensuring the ecosystem solves a broader range of problems for a larger segment of society.

The 2026 Outlook: Quality as the New Currency

Entering 2026, the Indian startup ecosystem is primed not for a chaotic boom, but for sustained, quality-driven leadership. The lessons of 2025 are now ingrained: capital is a privilege for those who build with discipline.

For founders, the mandate is clear: quality trumps quantity. The winning formula involves identifying a deep, defensible problem, leveraging technology to create an efficient solution, and scaling with a relentless focus on unit economics. The ecosystem, now matured under the principles of Atmanirbhar Bharat, has the capital, the talent, the infrastructure, and the market to support those who build to last. The era of easy money is over, but the era of monumental, sustainable impact has just begun.