Why 2025 Was a Milestone of Maturity for Indian Startups?

In the world of venture capital and high-growth businesses, headlines often worship the astronomical—the billion-dollar rounds, the meteoric valuations, the hyperbolic growth curves. But true strength isn’t always measured in vertical spikes; sometimes, it’s demonstrated in a steady, resilient climb against a challenging wind. The story of Indian startups in 2025 is precisely that: a powerful narrative of maturity, strategic focus, and enduring global confidence.

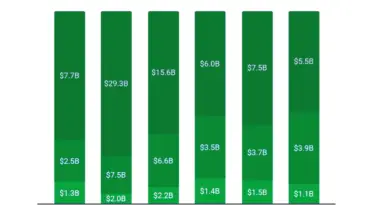

Yes, the top-line figure reveals a 17% year-on-year dip in total funding to $10.5 billion, a clear reflection of a cautious, selectivity-driven global capital environment. Yet, within that number lies a story of monumental stature: India not only held its ground but proudly retained its position as the world’s 3rd-largest funded startup ecosystem, standing firm behind only the US and UK, and notably ahead of giants like China and Germany. This isn’t a story of decline; it’s a story of incredible #EcosystemStrength.

The Resilience Metrics: Reading Between the Lines

To understand why 2025 was a ‘reset’ and not a ‘retreat’, we must look at the critical subplots:

- The Early-Stage Surge: While later-stage mega-deals cooled, early-stage (Seed & Series A) funding grew by a robust 7%. This is the most vital signal of health. It means that smart capital continues to flow to the founders of tomorrow, betting on innovative ideas with scalable, sustainable business models. The global VC community isn’t abandoning India; it’s becoming more discerning, funding the foundations of future giants.

- Sectoral Leadership & Logic: The continued dominance of enterprise applications (SaaS), retail (including D2C brands), and fintech is telling. These are sectors with clear paths to revenue, addressing deep, proven market needs both in India and for global exports (especially SaaS). The funding wasn’t chasing hype; it was consolidating around sectors with fundamentals for long-term profitability.

- The Triumph of Exits & Sustainable Unicorns: The narrative shifted from ‘valuation creation’ to ‘value creation’. The emergence of new unicorns alongside solid exit opportunities (through strategic acquisitions, secondary sales, and public markets) provided the essential return cycle for investors. This proves the ecosystem is no longer just a capital sink but a value-generating engine, which is crucial for its long-term survival and attractiveness.

2025: The “Great Rationality” and the Path Forward

The year represents what industry leaders are calling “The Great Rationality.” The era of growth-at-all-costs is giving way to a focus on:

- Unit Economics & Profitability: Startups are being judged on their path to positive unit economics, not just top-line GMV.

- Governance & Sustainability: Stronger corporate governance and sustainable scaling plans are now prerequisites for funding.

- Strategic Global Positioning: Indian SaaS and deep-tech startups are increasingly seen as global category leaders from day one.

This maturation is the bedrock of #FundingResilience. It shows the Indian startup story has evolved from a promising adolescent into a confident, capable adult, capable of navigating global economic cycles.

#StartupIndia: A Future Built on Strong Foundations

The #IndiaTech ecosystem has passed a critical stress test. The cautious global environment didn’t diminish its global standing; it reinforced it. The future looks strong not because of a speculative bubble, but because the foundation is now built on quality, operational discipline, and a relentless focus on solving real problems.

The capital is there—it’s just smarter. The ambition is there—it’s now more focused. The message for founders is clear: Build with substance, scale with sense, and the world will back you. For India, maintaining its podium position as the world’s third-largest startup hub in a challenging year is not just a statistic; it’s a testament to an ecosystem that is here to stay, innovate, and lead.

The reset is complete. The foundations are fortified. The next chapter of growth will be the most impressive yet.