India’s Startup Ecosystem 2025: A Year of Resilient Evolution and Strategic Maturation

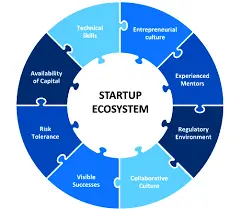

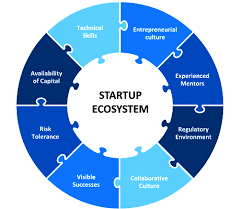

As the final chapter of 2025 closes, India’s startup narrative has decisively shifted from a tale of explosive, hype-driven growth to one of resilient evolution and strategic maturation. The ecosystem, now a formidable force of over 2 lakh (200,000) recognized startups creating more than 21 lakh (2.1 million) jobs, navigated a year of global economic uncertainty not with a retreat, but with a profound realignment. The defining story of the year was not the total amount of capital raised, but how it was deployed—with discipline, purpose, and a clear-eyed focus on the future. This year-end recap crystallizes the five pillars that have repositioned India for sustainable, global leadership in the coming decade.

1. Funding Resilience: The Triumph of Quality Over Quantity

While overall funding saw a market correction to approximately $10.5-$11 billion (a 17% year-on-year decline), this consolidation was a sign of health, not weakness. India retained its position as the world’s third-largest startup funding destination, proving its systemic importance to global capital. The critical shift was in selectivity: investors wrote larger cheques for fewer, higher-quality ventures, moving capital away from me-too ideas and towards companies with robust unit economics and scalable technology.

- The Deep-Tech Surge: The most telling statistic was the 46% year-on-year surge in deep-tech funding to $1.55 billion. This marked India’s decisive move up the value chain, as capital flooded into AI, semiconductor design, space tech, and biotechnology—sectors that build foundational intellectual property.

- Ample Dry Powder for the Future: Perhaps the strongest vote of confidence was the $12.1 billion committed to 81 new India-focused funds, a 39% annual increase. With war chests like Speciale Invest’s ₹1,400 crore fund and Pontaq’s ₹700 crore fund, the ecosystem is primed to fuel the best ideas of 2026 and beyond.

2. AI: From Buzzword to Bedrock Strategy

Artificial Intelligence transitioned from a trending sector to the central, organizing principle of the ecosystem. This was evidenced on two fronts:

- Infrastructure at Scale: Unprecedented infrastructure commitments exceeding $55 billion from Google, Microsoft, and Amazon began building the hyperscale data centers and cloud regions that will serve as India’s digital nervous system. This removes a critical bottleneck, allowing startups to build and train sophisticated models locally.

- Sovereign Innovation Rises: Homegrown AI companies like Sarvam AI and Krutrim made strides in building large language models for Indian languages, while applied AI startups in agriculture, healthcare, and enterprise SaaS demonstrated global competitiveness. The consensus among founders and investors is clear: 2026 will be the year of the “AI-first” pivot, where AI becomes the core of business strategy, not an added feature.

3. The Great Decentralization: Innovation Goes Local

One of the most transformative trends was the powerful decentralization of innovation beyond Bengaluru and Mumbai. State governments emerged as strategic partners, actively building regional hubs:

| State | Flagship Initiative | Focus & Impact |

|---|---|---|

| Karnataka | ₹518 Crore Startup Policy | Target of 25,000 startups, with 10,000 outside Bengaluru. |

| Maharashtra | MATRIX Program | Plan for 200+ incubators, focusing on agri-tech and rural entrepreneurship. |

| Rajasthan | ₹100 Crore Fund of Funds | To catalyze private investment in AI, cleantech, and agri-tech ahead of the TiE Global Summit. |

| Uttar Pradesh | Ecosystem Growth | Over 18,500 startups, including 8,000 founded by women. |

This push, combined with a surge in rural and Tier-2 innovation in agri-tech, cleantech, and health-tech, is creating a more resilient and nationally inclusive innovation economy.

4. Liquidity and Legitimacy: The Public Market Graduation

2025 was the year Indian startups truly graduated to the public markets. A record 42 IPOs, including blockbuster listings from Meesho, Groww, PhysicsWallah, and Ather Energy, unlocked over $19 billion in liquidity. This was a watershed moment with multiple benefits:

- Validation of Business Models: Public market success proved that sustainable, unit-economic-positive companies could be built at scale in India.

- Recycling of Capital: The exits provided massive returns for early investors and employees, fueling a virtuous cycle of reinvestment into the next generation of startups.

- Ecosystem Maturity: The slowdown in startup shutdowns to around 730 (down from prior years) indicated that weaker business models were being weeded out earlier, leading to a stronger, more durable base of companies.

5. Emerging Sectors: Building for Impact and the Future

Investor appetite broadened into mission-critical sectors aligned with global macro-trends and national needs:

- Cleantech & Sustainability ($1.95B funding): Startups in solar tech, EV infrastructure, and the circular economy gained traction.

- Space & Defence Tech: Digantara’s $50 million raise for space situational awareness and Skyroot’s launch preparations signaled the arrival of a strategic private space sector.

- HealthTech & Robotics: From FDA clearances for Indian med-tech to viral robotics demonstrations at IIT Techfest, deep-tech applied to human health and capability captured the imagination and capital.

The 2026 Outlook: Built on a Foundation of Discipline

Entering 2026, India’s startup ecosystem is stronger than ever—not because it is bigger, but because it is smarter, more resilient, and strategically aligned. The outlook is for deeper AI integration across all sectors, the rise of the first unicorns from emerging regional hubs, and a continued focus on sustainable scale over blitzscaling.

The lessons of 2025 have forged a new playbook. Under the guiding visions of Atmanirbhar Bharat and the IndiaAI Mission, the ecosystem is now engineered for endurance. For founders, the mandate is clear: the shifts of 2025 favor the bold, but only those who build with impact, intelligence, and integrity at their core. The era of easy money is over; the era of monumental, lasting impact has just begun.