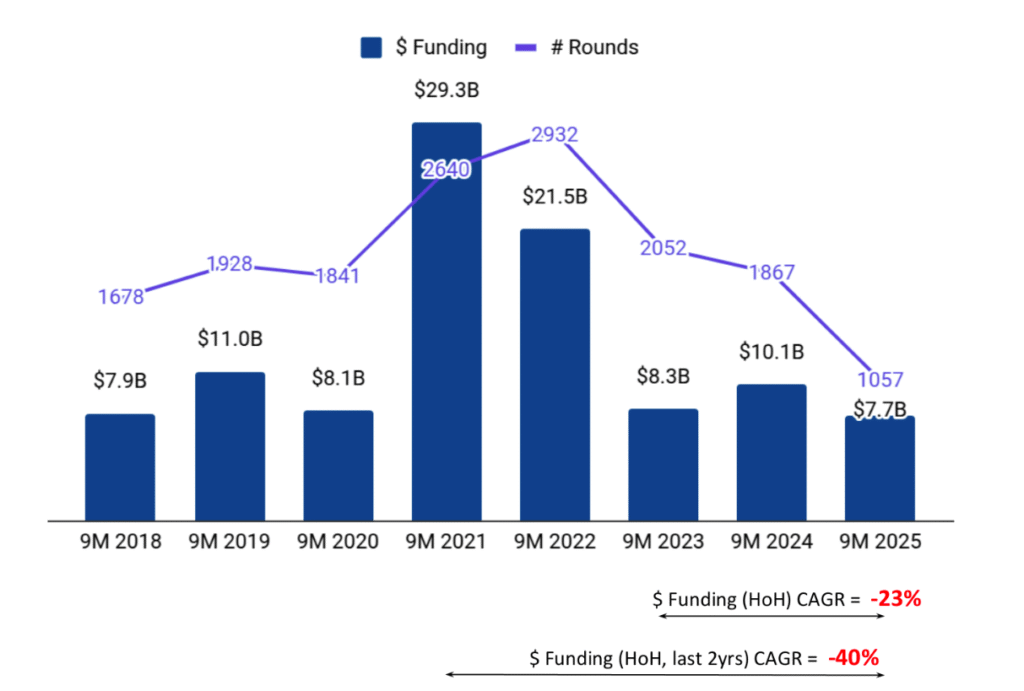

The Indian startup ecosystem has delivered a powerful message of resilience and maturity, securing its position as the third-largest tech startup hub in the world for the first nine months of 2025. According to the latest Tracxn ‘India Tech Funding 9M 2025’ report, Indian tech startups raised a formidable $7.7 billion across more than 1,460 funding rounds, trailing only the United States and the United Kingdom, and decisively outpacing European powerhouses like Germany and France.

Beyond the Dip: Signs of a Maturing Ecosystem

The decline in total funding volume is not a signal of weakness but a marker of a market correction. After a period of exuberant investment, capital is becoming more discerning. This selective investing is evident across stages:

- Seed Stage: $727M (down 39% YoY)

- Early-Stage: $2.7B (down 10% YoY)

- Late-Stage: $4.3B (down 27% YoY)

However, within this recalibration, several key metrics highlight underlying strength:

- Doubling of Median Round Size: The median funding round size has doubled to $1.5 million, indicating that while fewer companies are being funded, the ones that are, are receiving more substantial backing.

- Persistence of Mega-Rounds: The market still saw 10 mega-rounds exceeding $100 million, including a massive $1 billion round for Erisha E-Mobility, proving that investors retain deep conviction for high-potential, scaling businesses.

- Robust Unicorn & Exit Activity: India added 4 new unicorns, bringing the total to 122, and witnessed a vibrant exit environment with 110 acquisitions (up 15% YoY) and 26 IPOs that unlocked over $15 billion in liquidity.

As Neha Singh, Co-founder of Tracxn, noted, “Balanced exits and sector strength in enterprise, retail, and logistics reinforce India’s global competitiveness.” This liquidity is crucial as it recirculates capital and expertise back into the ecosystem.

Sectoral Deep Dive: Where the Smart Money is Flowing

The report highlights a clear triumvirate of sectors driving India’s tech narrative, demonstrating a shift towards B2B and foundational infrastructure.

1. Enterprise Applications: The Uncontested Leader ($2.3B)

Topping the charts, the enterprise software sector’s dominance is a testament to the global scalability of Indian SaaS. Driven by AI and cloud adoption, Indian B2B startups are solving critical business problems for customers worldwide, making this sector a perennial favorite for investors seeking resilient, high-margin business models.

2. Retail: The Consumption Powerhouse ($2.0B)

Securing $2.0 billion, the retail sector saw a 25% surge from the second half of 2024. This growth is fueled by the ongoing quick-commerce boom, the digitization of traditional retail, and strong consumer demand, underscoring the power of India’s domestic consumption story.

3. Transportation & Logistics Tech: The Backbone of the Economy ($1.79B)

This sector experienced an explosive 54% year-on-year growth, propelled by massive investments in electric mobility (EVs), supply chain tech, and logistics optimization platforms. As India’s economy modernizes, building efficient transportation and logistics networks becomes a top priority, attracting significant capital.

The Geographic Hubs: Bengaluru and Delhi-NCR’s Enduring Dominance

The concentration of innovation remains strong in India’s established hubs. Bengaluru accounted for 26% of all funding and is home to 53 unicorns, while Delhi-NCR (including Gurugram) claimed a 25% share with 20 unicorns. Together, these two regions form the undeniable powerhouse of Indian entrepreneurship.

Strategic Alignment and the Road Ahead

This funding performance aligns perfectly with the national Atmanirbhar Bharat (Self-Reliant India) and IndiaAI Mission. The strength in enterprise tech and logistics builds the digital and physical infrastructure for a self-reliant economy, while the focus on AI positions India to compete in the global $17 billion+ AI market.

The stage is set for a potential rebound in the second half of the year. The market has been cleansed of excess, capital is waiting to be deployed into quality businesses, and the exit pipeline provides positive reinforcement for investors.

Conclusion: The Podium is Secure, and the Race is On

India’s #3 global ranking is a monumental achievement. It confirms that the Indian startup ecosystem has graduated from an emerging story to an established global powerhouse. The current phase is not a winter but a “sensible season,” where sustainable unit economics and clear paths to profitability are prized above reckless growth.