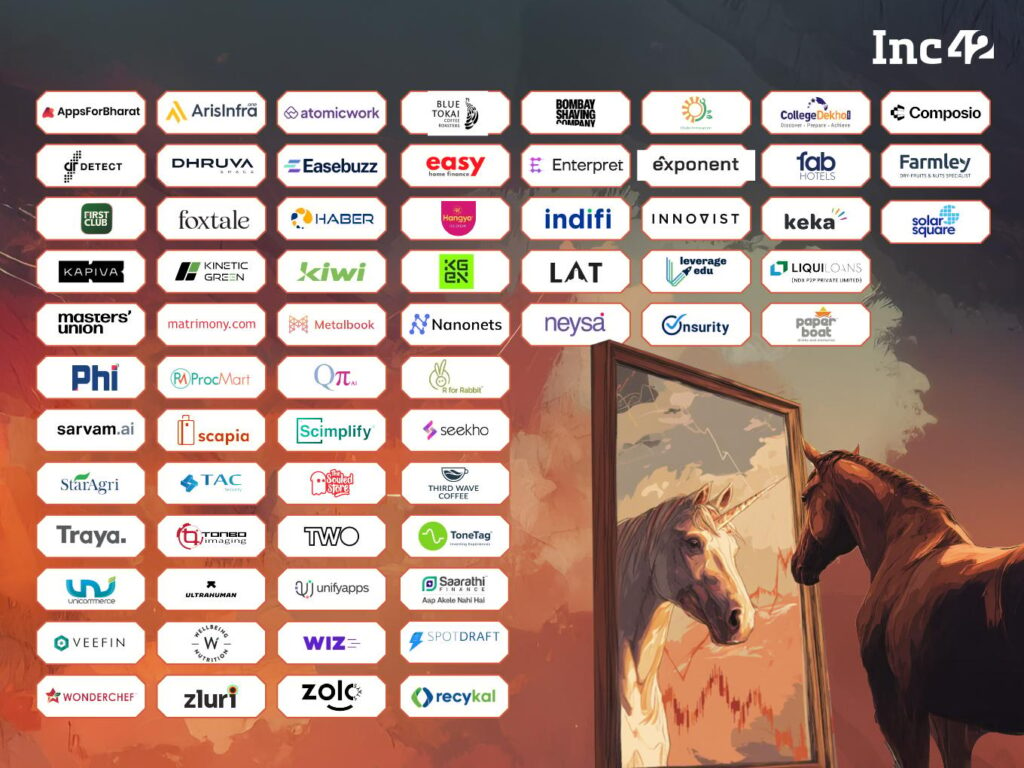

India’s startup landscape is witnessing the rise of a powerful new segment—67 “minicorn” startups valued between $100 million and $200 million—collectively representing $9.3 billion in valuation and having raised nearly $3 billion in funding. These high-growth ventures, identified in Inc42’s latest Minicorn Tracker, serve as the crucial bridge between early-stage innovation and future unicorn status, signaling a robust pipeline for India’s next decade of tech dominance.

Spanning sectors such as e-commerce, fintech, healthtech, and deep-tech, these minicorns demonstrate capital-efficient scaling and market-ready solutions. With only 0.1% of Indian startups reaching this valuation milestone, they represent an elite group of companies poised to define the next wave of India’s digital economy.

Minicorns by the Numbers: Key Metrics

Valuation and Funding Snapshot

- Total Minicorns: 67

- Collective Valuation: $9.3 billion

- Total Funding Raised: ~$3 billion

- Average Valuation Band: $100–200 million

Sector Distribution

- E-commerce: 16 minicorns

- Fintech & Enterprise Tech: Significant representation

- Healthtech, SaaS, and Deep-Tech: Emerging strongholds

- Diverse Verticals: Edtech, cleantech, agritech, and logistics

Leading Minicorns and Their Stories

E-commerce Frontrunners

- Geniemode

- Valued at: $196 million

- Focus: B2B sourcing and global trade platform

- Paper Boat

- Valued at: $180 million

- Focus: Authentic beverages and digital-first FMCG

- Foxtale

- Valued at: $170–180 million

- Focus: D2C skincare and personal care

Publicly Listed Minicorns

Five of these ventures have already achieved public market listings:

- Unicommerce (Mainboard)

- Matrimony.com (Mainboard)

- Arisinfra, Veefin, TAC Infosec (SME platforms)

The Road to Unicorn Status

What Makes a Minicorn?

- Product-Market Fit: Demonstrated scalability and user adoption

- Revenue Growth: Consistent quarter-on-quarter expansion

- Investor Confidence: Backing from top-tier VC firms

- Market Leadership: Emerging category leaders in niche segments

Pathways to Growth

- Geographic Expansion: Entering new states or international markets

- Product Diversification: Expanding offerings to capture greater wallet share

- Strategic Acquisitions: Acquiring smaller players to accelerate growth

- Public Listings: Leveraging public markets for capital and visibility

Investor Landscape: Who’s Backing the Minicorns

Active Venture Funds

- Blume Ventures

- Elevation Capital

- Nexus Venture Partners

- Fireside Ventures

- Other sector-specific funds

Investment Trends

- Larger Seed Rounds: Minicorns often began with substantial early funding

- Multiple Funding Rounds: Average of 3–4 rounds before reaching minicorn status

- Corporate Participation: Growing involvement from strategic corporate investors

Sector Deep Dive: Where Minicorns Are Thriving

E-commerce Evolution

- Shift from Horizontal to Vertical: Niche platforms outperforming broad marketplaces

- Profitability Focus: Unit economics taking precedence over gross merchandise value (GMV)

- Tier-2/3 City Penetration: Deepening reach beyond metropolitan areas

Fintech Innovation

- Embedded Finance: Banking-as-a-service and API-driven solutions

- SME Lending: Addressing the credit gap for small businesses

- Wealth Tech: Democratizing investment access for retail investors

Healthtech Transformation

- Telemedicine 2.0: Specialized consultations and chronic disease management

- Diagnostic Innovation: At-home testing and AI-powered analysis

- Mental Health: Digital platforms for counseling and wellness

The Broader Ecosystem: Supporting the Minicorn Ascent

Government Initiatives

- ₹10,000 Crore Deep Tech Fund: Supporting AI, semiconductor, and advanced technology startups

- Startup India Seed Fund Scheme: Providing early-stage capital

- State-level Policies: Karnataka, Tamil Nadu, and others offering sector-specific support

Market Tailwinds

- Digital Adoption: Post-pandemic acceleration in e-commerce and digital services

- Mobile Penetration: 800+ million internet users driving digital business models

- Payment Infrastructure: UPI and digital payments enabling seamless transactions

From Minicorn to Unicorn: Expected Trajectory

Projected Unicorn Pipeline

- 100+ New Unicorns expected by 2030

- Many current minicorns likely to achieve unicorn status within 2–3 years

- Sector Leaders: E-commerce, fintech, and SaaS expected to produce the most unicorns

Success Factors

- Sustainable Growth: Balancing growth with profitability

- Talent Acquisition: Attracting and retaining top-tier talent

- Global Ambition: Expanding beyond Indian markets

- Technology Edge: Leveraging AI and data analytics for competitive advantage

Challenges on the Horizon

Scaling Pressures

- Operational Complexity: Managing distributed teams and supply chains

- Customer Acquisition: Rising costs in competitive markets

- Regulatory Compliance: Navigating evolving digital regulations

Market Challenges

- Economic Cycles: Maintaining growth during economic downturns

- International Competition: Competing with global players entering India

- Execution Risk: Successfully managing rapid scaling

Conclusion: India’s Startup Ecosystem Comes of Age

The emergence of 67 minicorns represents a maturation of India’s startup ecosystem, demonstrating that the country can produce not just early-stage innovation but also scalable, sustainable businesses with significant market value. These companies represent the critical middle layer of India’s startup pyramid—proving that with the right combination of innovation, execution, and funding, Indian startups can achieve world-class scale.

For entrepreneurs, the minicorn milestone validates that building in India, for the world is a viable strategy. For investors, it confirms that patient capital in Indian startups can generate substantial returns. And for the economy, it signals that startups are becoming a fundamental engine of job creation, innovation, and global competitiveness.