In a striking signal of confidence in India’s deep-tech ambitions, Bengaluru-based aerospace startup Airbound has secured $30 million in a fresh funding round led by Greenoaks Capital. This investment, with participation from Lightspeed Venture Partners, arrives just two months after an $8.65 million seed round, bringing the young company’s total funding to over $40 million. This rapid-fire fundraising highlights surging investor appetite for the potentially transformative impact of drone technology on India’s vast logistics sector.

Decoding the Investment

For the Indian startup ecosystem, this deal is a landmark for the aerospace and robotics deep-tech sector, proving that R&D-heavy, hardware-focused ventures can attract major institutional capital. It provides a blueprint for other startups working on complex, capital-intensive innovations.

The Airbound Proposition: Technology and Vision

Founded in 2023 by 20-year-old Naman Pushp and a team of aerospace engineers, Airbound is tackling last-mile logistics with a unique hardware solution.

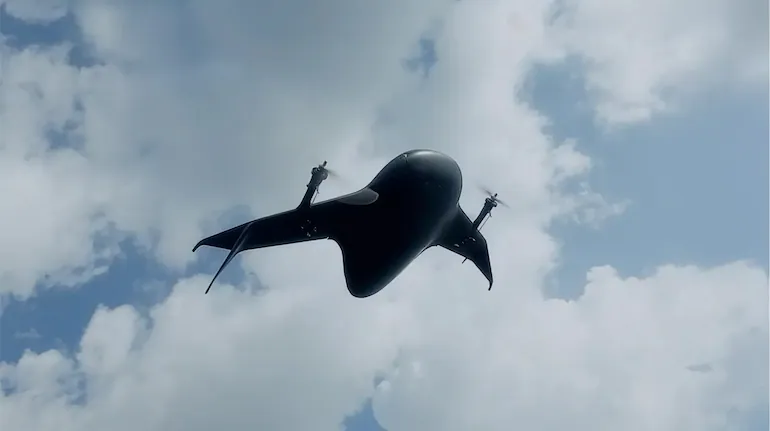

- Innovative Drone Design: The company’s core technology is a “blended-wing-body” drone, which functions as a “tail-sitter.” This design allows it to take off and land vertically like a helicopter (eliminating the need for runways) and then transition to cruising efficiently like a fixed-wing airplane. This hybrid approach aims to maximize range and payload efficiency.

- The Economic Promise: Airbound claims its drones can slash delivery costs to an astonishing ₹1 (approximately $0.012) per kilometer for payloads under 3kg. If achieved at scale, this would fundamentally alter the economics of delivery, especially in remote or congested areas.

- Strategic Market Entry: The startup is wisely starting with healthcare logistics, piloting deliveries of blood samples and vaccines with partners like Narayana Health. This sector presents urgent, high-value use cases with regulatory pathways. Its roadmap then expands to food and grocery delivery by 2026, aiming for a massive 1 million daily deliveries by mid-2027.

Capital Deployment and the Path Ahead

The new $30 million infusion is earmarked for critical scaling objectives:

- Manufacturing Scale-Up: Ramping production capacity to over 100 drones per day to meet anticipated demand.

- Regulatory Clearance: Securing necessary approvals from India’s Directorate General of Civil Aviation (DGCA) for commercial, beyond-visual-line-of-sight (BVLOS) operations. This is a crucial and complex hurdle.

- Technology and Team Development: Further refining its in-house AI autonomy software and propellers, and expanding its engineering and operations talent.

- Sector Expansion: Moving beyond healthcare pilot programs to establish commercial operations in other logistics verticals.

Market Context and Competition

Airbound is soaring into a market ripe for disruption. India’s logistics sector is estimated at over $200 billion, with last-mile delivery being a persistent bottleneck. Government initiatives like Production-Linked Incentive (PLI) schemes for drones and the National Drone Policy are actively fostering the ecosystem.

However, the company is not alone. It faces competition from well-funded domestic players like Skye Air and TechEagle, which are also conducting pilot projects and scaling their operations. The global drone logistics market is projected to exceed $15 billion, attracting significant international players as well. Airbound’s unique design and aggressive cost targets will be its key differentiators in this emerging race.

Challenges on the Horizon

Despite the excitement, Airbound’s journey involves navigating significant challenges:

- Regulatory Hurdles: Obtaining widespread DGCA approval for dense urban or long-range BVLOS flights is a multi-step, uncertain process critical to its business model.

- Public Acceptance and Safety: Integrating drones safely into shared airspace above cities and gaining public trust is a major societal and operational challenge.

- Execution at Scale: Moving from successful pilots to a reliable, nationwide, million-deliveries-a-day operation is a colossal leap in manufacturing, maintenance, and logistics management.

- Proving Unit Economics: The promised cost of ₹1/km must be proven not just in controlled tests but in real-world, scaled operations.

A Symbiotic Rise for Indian Deep-Tech

Airbound’s funding success story is not an isolated event. It reflects a maturing Indian venture capital landscape that is increasingly willing to back frontier technologies. This trend is evident in other recent major fundraises, such as:

| Fund/Startup | Sector | Amount Raised | Key Investor(s) |

|---|---|---|---|

| IAN Alpha Fund | Early-Stage VC Fund | $100 Million Final Close | Buimerc Corp, HDFC Life, NABARD |

| IIT Bombay Deep-Tech Fund | University VC Fund | ₹250 Crore (~$30M) | Managed by SINE (IITB) |

| Airbound | Aerospace/Drones | $30 Million Series A | Greenoaks Capital, Lightspeed |

This table shows a synchronized push across the ecosystem—from university funds and angel networks to global growth equity—all fueling India’s deep-tech revolution in sectors like drones, AI, and semiconductors.

Conclusion: Redefining Mobility from the Skies Down

Airbound’s $30 million round is a milestone for India’s ambition to be a technology creator, not just an adopter. As CEO Naman Pushp stated, the goal is to “redefine affordable, infrastructure-free mobility.” If Airbound can successfully navigate the regulatory landscape, master the complexities of scale, and deliver on its revolutionary cost promises, it will do more than build a successful company.